Blog: Monthly Index: Aug 2014

Oxford supermarket comes out on top in our August 2014 PriceShare Index, captured 23 August.

While there are still several Upper Highway stores missing, the early data on the site begins to give us a picture of how the stores compare on price. While the results should be observed with caution, there are some clear trends emerging and worth commenting on.

See the full blog for a breakdown of the data, and what conclusions we can and can't draw from the data.

While there are still several Upper Highway stores missing, the early data on the site begins to give us a picture of how the stores compare on price. While the results should be observed with caution, there are some clear trends emerging and worth commenting on.

See the full blog for a breakdown of the data, and what conclusions we can and can't draw from the data.

The first monthly index is in today, August 23. As a regular feature of PriceShare, the index allows us to compare store prices and track changes. Who will come out on top?

A Word of Caution

Before we begin, just a note regarding averages. The quality of an average score depends on how much data you have. Because PriceShare is at an early stage of price gathering, these averages are likely to move around quite heavily over the next few months. So what do we recommend then? Just sit back and enjoy the show, but don't switch your entire yearly shopping spend just yet.

We're also missing several stores. Most Pinetown stores are not included, and we also don't have any prices from KwikSPAR and SPAR Kloof. I'm sure there are other stores our observers would like to see reflected. Note also that our chain comparison covers a number of stores on Dolphin Coast and Durban South. In due time we'll have localised indices for these areas too.

How is the Index Calculated?

We look at every single product in the database, and calculated the average price across stores for each product. Obviously if we're comparing just a region, like Upper Highway, we only look at prices in that region.

We then look at each store and find products that have been captured for that store, which at this stage usually numbers a few hundred out of the 2,154 products stored so far. For each product, we compare the price against the average, and get a percentage difference. We then add up all the percentage differences and get an average difference.

Note that specials are not included in our data.

The important thing to remember is that nearly all the match-ups are on existing branded products, so if you're buying XY-branded Toothpaste, whether you get it at Woolworths or Oxford makes no difference regarding quality - the quality of the product is the same.

What are the Risks?

Obviously, a particular store or chain may specialise in a particular product range, and if we've captured that, we might overly boost their results, or if we've missed that, underestimate their price performance.

Secondly, on some stores we just don't have a lot of prices to match up on. If they had more stock, we'd get a more reliable result.

Finally, stores can choose what level of stock to make available. For instance, an especially cheap product might simply not be available at a "fancy" store, meaning that despite their good performance on comparisons, you'll still end up paying more at the store.

Results for All Chains in KZN

The data below is based on the following, as at 23 Aug 2014:

http://priceshare.co.za/Compare/CompareChain

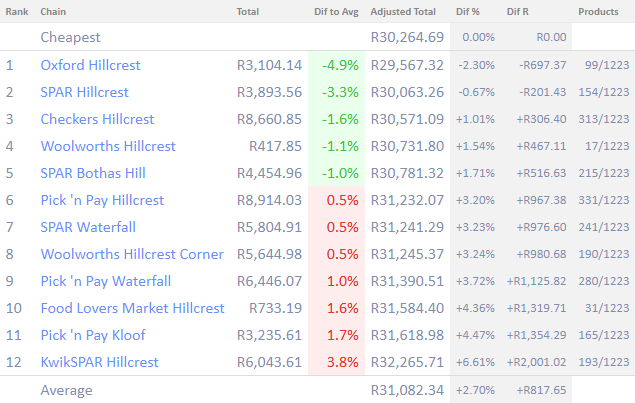

The Results for Upper Highway

The data below is based on the following, as at 23 Aug 2014:

http://priceshare.co.za/Compare/CompareStore?storeIds=&basketId=®ionId=2&includeSpecials=false

Breakdown by Chain

Oxford

With 99 products matched, the data is still a little bit raw, but not to be sniffed at. Even now, Oxford is already 3.1% cheaper than it's nearest competing chain, which is worth hundreds to thousands on your yearly shopping spend. Oxford actually has a pretty strong product selection, rather than just being a fresh product market. The big gotcha is obviously the limited number of Oxford stores available.

Game

Game are only just moving into the fresh product space with their Pinecrest overhaul, but these changes are not yet reflected. Early indicators on 126 products matched are that you can get a decent selection of your grocery shopping done there at a great price.

Checkers

With 671 products matched, Checkers are showing a strong selection at great prices. A very good early contender.

SPAR

With 661 products matched, SPAR are the surprise early runners, particularly as there seems to be a market perception that they're more expensive than other chains. The data already indicates this perception might be wrong, but let's wait for a stronger fresh produce selection before drawing heavy conclusions.

Shoprite

In terms of LSM placement, you might imagine Shoprite would be more competitive pricewise, but with 402 products matched, the data is not looking great. At this stage, sister chain Checkers is outperforming.

Save

Save are roughly Pmb's equivalent of Oxford, a lower price alternative to the major chains. Having built up a reputation as a low cost operator, the early pricing is not particularly promising. At 134 products matched, you'd imagine there is still hope of a recovery.

Pick 'n Pay

Certainly the big loser of the early results, you'd have imagined that PnP would want to be near the front of the pack. Already 1.5% behind Checkers, a growing database will need to paint them in a better light.

Food Lovers Market

FLM are not well reflected in these results, because they only match on a limited selection of branded products, rather than on the bulk of their offering, which is fresh produce and meat. These results shouldn't be taken seriously, with only 31 products matched.

Woolworths

We've managed to match a surprising 424 products at WW, surprising because most of their stock is house-branded. However, it might not be a surprise that the high-LSM operator is charging more on other branded products, choosing to pay for their decor and service by increasing their margins. It will be interesting to see how the results improve, or worsen, as we begin to match actual fresh produce.

KwikSPAR

As a convenience store, it will come as little surprise that KwikSPAR are adding margins to their products to cover for their longer hours. We published a report a few weeks ago highlighting the difference, and here already we're seeing that they're some 8.8% more expensive than Oxford.

SaveRite

As a convenience store, you can understand SaveRite compensating for low throughput by raising margins. At 11.7% more than Oxford, you'd imagine heavy shopping would be done elsewhere, assuming alternatives are available. Note that the data is a touch limited for SaveRite at this stage.

What Next?

We're continuing to build up our data for now. Towards the end of September you'll see the next index, including a greater focus on fresh veg, fruit and meat. By the end of the year there will be a 2014 index up for scrutiny. Obviously we appreciate all the help we can get to capture prices and build up the confidence we have in our data offering for you.

A Word of Caution

Before we begin, just a note regarding averages. The quality of an average score depends on how much data you have. Because PriceShare is at an early stage of price gathering, these averages are likely to move around quite heavily over the next few months. So what do we recommend then? Just sit back and enjoy the show, but don't switch your entire yearly shopping spend just yet.

We're also missing several stores. Most Pinetown stores are not included, and we also don't have any prices from KwikSPAR and SPAR Kloof. I'm sure there are other stores our observers would like to see reflected. Note also that our chain comparison covers a number of stores on Dolphin Coast and Durban South. In due time we'll have localised indices for these areas too.

How is the Index Calculated?

We look at every single product in the database, and calculated the average price across stores for each product. Obviously if we're comparing just a region, like Upper Highway, we only look at prices in that region.

We then look at each store and find products that have been captured for that store, which at this stage usually numbers a few hundred out of the 2,154 products stored so far. For each product, we compare the price against the average, and get a percentage difference. We then add up all the percentage differences and get an average difference.

Note that specials are not included in our data.

The important thing to remember is that nearly all the match-ups are on existing branded products, so if you're buying XY-branded Toothpaste, whether you get it at Woolworths or Oxford makes no difference regarding quality - the quality of the product is the same.

What are the Risks?

Obviously, a particular store or chain may specialise in a particular product range, and if we've captured that, we might overly boost their results, or if we've missed that, underestimate their price performance.

Secondly, on some stores we just don't have a lot of prices to match up on. If they had more stock, we'd get a more reliable result.

Finally, stores can choose what level of stock to make available. For instance, an especially cheap product might simply not be available at a "fancy" store, meaning that despite their good performance on comparisons, you'll still end up paying more at the store.

Results for All Chains in KZN

The data below is based on the following, as at 23 Aug 2014:

http://priceshare.co.za/Compare/CompareChain

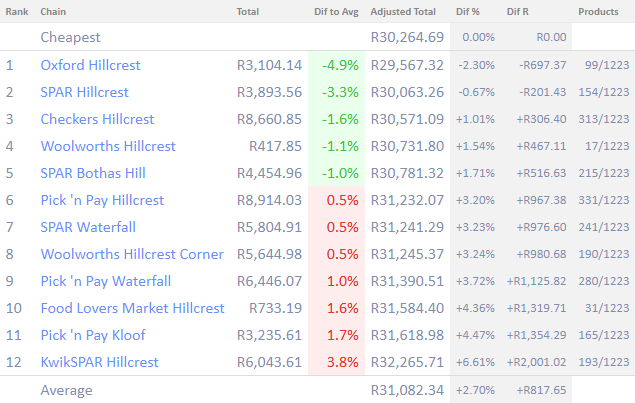

The Results for Upper Highway

The data below is based on the following, as at 23 Aug 2014:

http://priceshare.co.za/Compare/CompareStore?storeIds=&basketId=®ionId=2&includeSpecials=false

Breakdown by Chain

Oxford

With 99 products matched, the data is still a little bit raw, but not to be sniffed at. Even now, Oxford is already 3.1% cheaper than it's nearest competing chain, which is worth hundreds to thousands on your yearly shopping spend. Oxford actually has a pretty strong product selection, rather than just being a fresh product market. The big gotcha is obviously the limited number of Oxford stores available.

Game

Game are only just moving into the fresh product space with their Pinecrest overhaul, but these changes are not yet reflected. Early indicators on 126 products matched are that you can get a decent selection of your grocery shopping done there at a great price.

Checkers

With 671 products matched, Checkers are showing a strong selection at great prices. A very good early contender.

SPAR

With 661 products matched, SPAR are the surprise early runners, particularly as there seems to be a market perception that they're more expensive than other chains. The data already indicates this perception might be wrong, but let's wait for a stronger fresh produce selection before drawing heavy conclusions.

Shoprite

In terms of LSM placement, you might imagine Shoprite would be more competitive pricewise, but with 402 products matched, the data is not looking great. At this stage, sister chain Checkers is outperforming.

Save

Save are roughly Pmb's equivalent of Oxford, a lower price alternative to the major chains. Having built up a reputation as a low cost operator, the early pricing is not particularly promising. At 134 products matched, you'd imagine there is still hope of a recovery.

Pick 'n Pay

Certainly the big loser of the early results, you'd have imagined that PnP would want to be near the front of the pack. Already 1.5% behind Checkers, a growing database will need to paint them in a better light.

Food Lovers Market

FLM are not well reflected in these results, because they only match on a limited selection of branded products, rather than on the bulk of their offering, which is fresh produce and meat. These results shouldn't be taken seriously, with only 31 products matched.

Woolworths

We've managed to match a surprising 424 products at WW, surprising because most of their stock is house-branded. However, it might not be a surprise that the high-LSM operator is charging more on other branded products, choosing to pay for their decor and service by increasing their margins. It will be interesting to see how the results improve, or worsen, as we begin to match actual fresh produce.

KwikSPAR

As a convenience store, it will come as little surprise that KwikSPAR are adding margins to their products to cover for their longer hours. We published a report a few weeks ago highlighting the difference, and here already we're seeing that they're some 8.8% more expensive than Oxford.

SaveRite

As a convenience store, you can understand SaveRite compensating for low throughput by raising margins. At 11.7% more than Oxford, you'd imagine heavy shopping would be done elsewhere, assuming alternatives are available. Note that the data is a touch limited for SaveRite at this stage.

What Next?

We're continuing to build up our data for now. Towards the end of September you'll see the next index, including a greater focus on fresh veg, fruit and meat. By the end of the year there will be a 2014 index up for scrutiny. Obviously we appreciate all the help we can get to capture prices and build up the confidence we have in our data offering for you.

Posted by Eric Savage on 23 Aug 2014 14:40.

Would you like to discuss this blog? Create a topic in the forums.

Would you like to discuss this blog? Create a topic in the forums.